Natural capital - market framework: engagement paper

This engagement paper summarises the key natural capital market framework co -development issues and questions that will be explored. The content will be used to help inform, guide and support all participants during the engagement and co-development process.

Section 2: Governance in Natural Capital Markets

The UK’s National Standards Body, the British Standards Institution (BSI), has worked closely with the UK Government, the devolved administrations and a wide range of stakeholders to create ‘BSI Flex 701 Nature Markets – Overarching Principles and Framework – Specification v1.0’ (March, 2024). This standard sets requirements for the design and operation of high-integrity nature markets, including processes to generate, trade and store nature units. The BSI Standards provide an initial articulation for how UK nature markets should function to ensure high integrity. [5]

Section summary:

“Integrity is the bedrock of nature markets. It means that credits or units

awarded and sold for benefits, such as biodiversity, carbon capture or water quality,

must reflect genuine, lasting and additional environmental improvements, which are robustly verified and transparently documented, with no double counting, misleading claims or negative unintended consequences, for example for non-target ecosystem services or local communities.” (BSI, 2023)

The Scottish Government welcomes the first iteration of the BSI’s standards and will engage in their review, discussion, improvement and – crucially – adoption. We also support the likely development of further thematic standards, particularly for biodiversity and community benefit.

Please consider:

- How should Scotland help to ensure schemes and projects conform to the BSI’s standards?

- How can Scotland’s M arket F ramework further strengthen the governance of natural capital markets, alongside the BSI’s standards?

Detailed discussion:

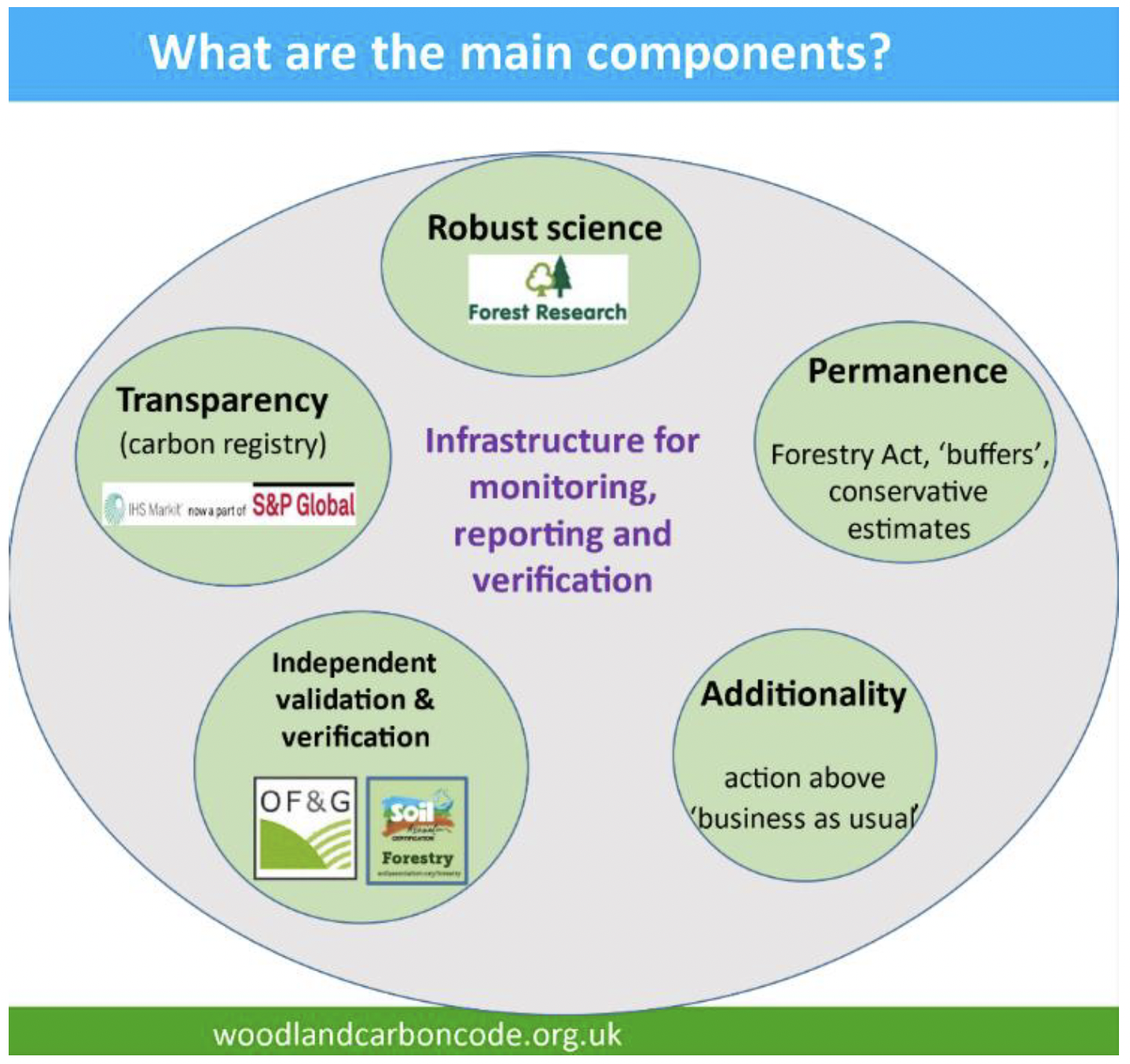

This section starts by presenting the case studies of the UK’s Woodland Carbon Code (WCC) and Peatland Code (PC). The WCC and PC are important because they currently fulfil many governance requirements for woodland and peatland projects entering the voluntary carbon markets.

The section then selects some of the ‘market principles’ within BSI’s nature standard for additional commentary. Finally, the section presents the BSI’s remaining market principles as a list. For brevity, we’ve omitted most BSI standard’s subclauses, these can be found in their original document (here).

1. Case Study: The Woodland Carbon Code (WCC) and Peatland Code (PC)

Quality codes, standards, schemes, initiatives and other governance mechanisms are essential for high-integrity natural capital markets. They are needed to achieve the key natural capital principles including additionality, permanence, robust measurement and transparency. Their existence facilitates the creation of payment for, and investment in, units of natural capital.

The Government-backed WCC and PC have helped to position Scotland as a leading place for responsible investment in natural capital markets. These UK wide voluntary certification standards are currently the main mechanisms in the UK to attract private investment in natural capital. They issue units for each ton of naturally sequestrated carbon. Woodland and peatland projects looking to produce credits through these codes must first follow a process of validation. Projects are allocated Pending Issuance Units (PIUs)[6] which can be bought and sold. These are ultimately verified and converted to Carbon Units (PCUs and WCUs) which can be used by companies to report against UK based emissions or to use in claims of carbon neutrality or Net Zero emissions. The UK’s WCC and PC are recognised for their high level of integrity. Independent validation of these standards provide assurance and clarity for buyers with regards the quantity and quality of emissions reductions purchased.

1. BSI Principles on ‘Buyer integrity’

The integrity of a nature market is reliant on the circumstances of a credit’s sale. High integrity nature markets require credits to be used in the right way. For example, buyers can only use credits to offset unavoidable and negative environmental impacts (VCMI, 2023). The purchase of nature credits for less ambitious purposes, for example offsetting avoidable, minimizable or repairable impacts, is considered greenwashing. Such practices undermine market integrity.

The BSI identify three principles determining high-integrity purchase of units:

- Reducing Environmental Impacts Principle: Purchased units are used to reduce environmental impacts, based on a mitigation hierarchy (BSI, 2024).

- Claims Principle: Claims of environmental performance, based on units purchased in nature markets, measure that performance in a manner aligned to the measurement processes used to quantify the units for sale (BSI, 2024).

- Ethical Actors Principle: Buyers and suppliers provide information to allow market stakeholders to assess their integrity (BSI, 2024).

Additional Commentary: Most natural capital markets are yet to build processes to ensure the adoption of these principles. This is perhaps the key governance issue that needs addressing.

Nature markets will likely require buyer integrity checks, including:

- checks to ensure buyers have followed a suitable mitigation hierarchy;

- checks to ensure buyers have adhered to accounting and communications guidelines; and,

- know your customer and anti-money laundering checks.

Reviewed literature recommends that buyer checks should be:

- primarily funded by the buyer (polluter pays principle);

- accurate enough to be credible but cost-effective enough to avoid compromising the viability of natural capital markets (Kerchner & Keeton -2015);

- equitable to ensure smaller entities are not shut out of the market.

Evidence suggests many current buyers would require preparatory work to pass the introduction of high-integrity tests. For example, Trove Research (MSCI, 2023) finds that current voluntary practice worldwide does not yet meet the Voluntary Carbon Market Initiative’s (VCMI) ‘Claims Code of Practice’ criteria. Given reasons include buyers lacking sufficiently robust net-zero commitments; buyers being off-track on their emission reduction targets; buyers using offsets excessively; and buyers not disclosing credits accurately.

2. BSI Principles on Additionality

BSI Additionality Principle: “Sellers are responsible for selling units that are additional.” (BSI, 2024)

Additional Commentary: All units issued in nature markets must be based on new environmental improvements that wouldn’t have happened otherwise in absence of the intervention. This is known as additionality. Additionally is vital in nature markets and must be verified against appropriate baselines.

High-integrity codes should verify additionality using a legal additionality test, and at least one other additionality test.

- a legal test – is a check that actions to supply units were not required under a legal or statutory mechanism;

- a financial test – assesses whether the relevant nature unit-based revenues are needed for a project to be financially viable; and

- a common practice test or a barrier test – assesses whether actions are already part of normal environmental management, or if they face barriers that are not otherwise overcome.

3. BSI Principles on Stacking

BSI Stacking Principle: Multiple types of units can be sold from the same supply area[7] as part of a stack when there is robust measurement and verification of additionality in place for each type of unit in the stack.

Stacking is when a project developer sells separate environmental outcomes from the same supply area in more than one nature unit. This can create multiple income streams and assist in meeting the need and expectation for a financial return on investment. As the market develops, a key governance consideration will become the conditions under which different credits can be stacked. A reliable system of stacking could promote integrated land use by allowing income to be earned for delivering more than one benefit from the same area of land (see section 3).

However, staking credits increases the risk of double counting. To avoid risks such as this the BSI’s subclauses include stipulations that every unit in a stack should:

- be quantified and verified;

- pass additionality tests; and

- be accompanied by a statement declaring that the units are stacked on a market registry that has interoperability of information with the registries for the other units in a stack.

The WCC states that in future it may be possible to ‘stack’ voluntary credits generated from a woodland creation project provided:

- there is a credible voluntary standard for other ecosystem services;

- these standards are approved for use by the WCC Secretariat;

- all income streams are declared in the WCC cashflow spreadsheet; and

- claims made are clear and explicit.

Similarly, the Peatland Code is working in collaboration with the UK Land Carbon Registry to make stacking operational in a future version of the Peatland Code. It says mechanisms would be needed to ensure stacking does not compromise the integrity of the market, including:

- the existence of credible voluntary standards for each ecosystem service in the stack;

- the development of methods that could be used by the Peatland Code Executive Board to approve their use with Peatland Code projects; and

- methods for distinguishing bundled projects (in which other ecosystem services are sold as part of a bundle of benefits) from stacked projects for buyers, including mechanisms to show this on the UK Land Carbon Registry and to ensure checks are made between registries to avoid double-counting, so that claims are clear and explicit.

4. BSI Principles on Permanence

BSI Permanence Principle: Standards and schemes issuing units set out provisions to enable permanence of contracted environmental outcomes (BSI, 2024).

Environmental improvements must be maintained indefinitely. This can be attained through legal means. For example, the Forestry and Land Management (Scotland) Act (2018) mandates the replanting of felled trees. Alternatively, contracts can be used to enforce long-term maintenance. High-integrity codes such as the WCC and PC safeguard permanence by requiring “buffers” of unsold units to ensure enough can be returned upon an unexpected reversal. They can also ensure the initial release of credit are structured against defined milestones.

The BSI standards require suppliers to plan and undertake actions to ensure their environmental outcomes are lasting. It requires suppliers to cover the costs of actions necessary to supply units for their whole duration, including recognising unit delivery risks and planning mitigations. This will involve suppliers anticipating and accounting for the increased risks created by climate change. For example, where climate change results in a supply area’s increased fire risk, this should be included in management of the supply area; not doing so would be “neglect” that failed a permanency check. This will also mean that when land used to supply units is sold the obligation for that land to supply units must remain. Furthermore, suppliers must undertake proportionate actions to rectify losses should damage to a supply area reduce the supply of units sold (exempted by force majeure). Finally, the generation of nature units should include provisions such as contingency, insurance or a buffer of units to ensure positive environmental outcomes are lasting.

5. BSI Principles on Measurement

BSI Quantification Principle: The measurement of units is robust and is made transparent between market participants and stakeholders (BSI, 2024).

The BSI’s subclauses include stipulations that the quantification of units shall:

- be defined using a recognised classification;

- use methods based on published science;

- provide the available information relevant to assess additionality, relative to the baseline;

- be carried out over the units’ lifetime;

- specify the measurement metric(s), as well as the supply area, date and timing of the measurement; and

- state the party who undertook the quantification, and the skills and knowledge that makes them competent to do so.

6. Remaining BSI Principles

Principles shared across market participants

- Transparency Principle: Market participants make material information about the supply and trading of units available to market stakeholders, unless it is commercially confidential (for example, price) (BSI, 2024).

- Governance Principle: The status and governance of a market participant, and the governance processes of a market standard, is stated to other participants and stakeholders (BSI, 2024).

- Timing Principle: The timing of the material information is transparent to market stakeholders (BSI, 2024).

- Competency Principle: The requirements of the BSI standards are carried out by competent individuals and organisations (BSI, 2024).

- Innovation Principle: Rules and requirements of market participants facilitate the adoption of new technologies or practices (BSI, 2024).

- Integration Principle: Buyers, sellers and market initiatives recognise that nature is multi-functional, producing a range of benefits, including the ability to adapt and mitigate climate change, which different stakeholders value in different ways. (See Section 2)

- Engagement Principle: Nature market participants’ engagement with local communities is transparent. (See Section 2)

Selling units

- Supply Principle: Sellers are responsible for the integrity of units sold, and for demonstrating that integrity to market stakeholders (BSI, 2024).

- Unintended consequences Principle: Actions to supply units from a supply area avoid material negative environmental impacts (BSI, 2024).

- Validation and verification Principle: Sellers supply units that are validated and verified (BSI, 2024).

- Engagement with communities Principle: Suppliers undertake proportionate engagement with communities in relation to material environmental impacts of management actions to supply units (See Section 2).

Registries

- Registry Principle: The quantification, generation, trading and storage of units is recorded in registries, which make material information transparent and accessible to market stakeholders (unless it is commercially confidential), and consistent across nature markets (BSI, 2024).

- Interoperability Principle: Information in nature markets is comparable such that it enables the regulation and understanding of interactions between markets (BSI, 2024).

Trading Practices

- Access Principle: Processes of market trading and/or engagement enable access of market stakeholders (BSI, 2024).

- No double counting Principle: Environmental outcomes from actions to supply units in nature markets, whether or not they are explicitly sold, are only counted once (BSI, 2024).

7. Next steps

With a growing number of markets operating, or close to operating in the UK, a constant attention to building and maintaining effective systems of market governance is needed. To steer the development of market governance, the Scottish Government works in partnership with the UK government and other devolved nations to build the required infrastructure at a UK level. This approach ensures Scotland can use existing partnerships and collaborative efforts to support the growth and integrity of natural capital markets on a broader scale, ensuring consistency and coherence in approach across the UK.

Contact

Email: PINC@gov.scot

There is a problem

Thanks for your feedback